GIVING FUND EXTENDS A HAND FOR HUMANITY THIS CHRISTMAS

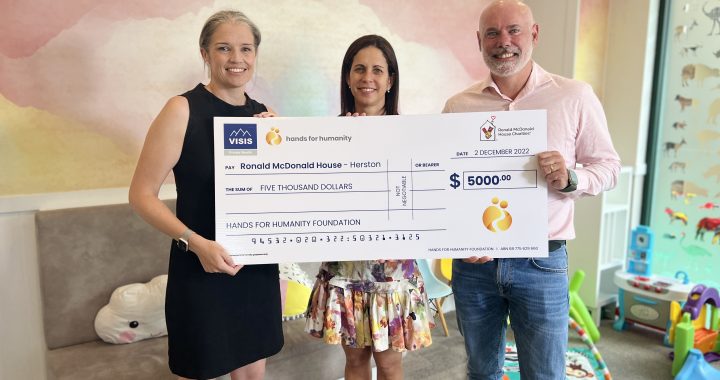

St Vincent de Paul Society Queensland and Ronald McDonald House have jointly received $10,000 in donations from Hands for Humanity Foundation (H4H), a giving fund established by the founders of VISIS Private Wealth firm Wendy and Chris Smith.